Welcome to the 99% substack

Will Debt Hysteria Destroy the UK?

Hi and welcome to our 1st post on substack!

This is from our weekly newsletter to members so I apologise to 99ers who may have seen this already. If you’re new to us then i hope this is a good introduction to how we write about the issues facing the UK.

Will Debt Hysteria Destroy the UK?

Last week’s OBR report claims that UK faces "daunting risks" to our public finances and that our ability to respond to future shocks is substantially eroded.

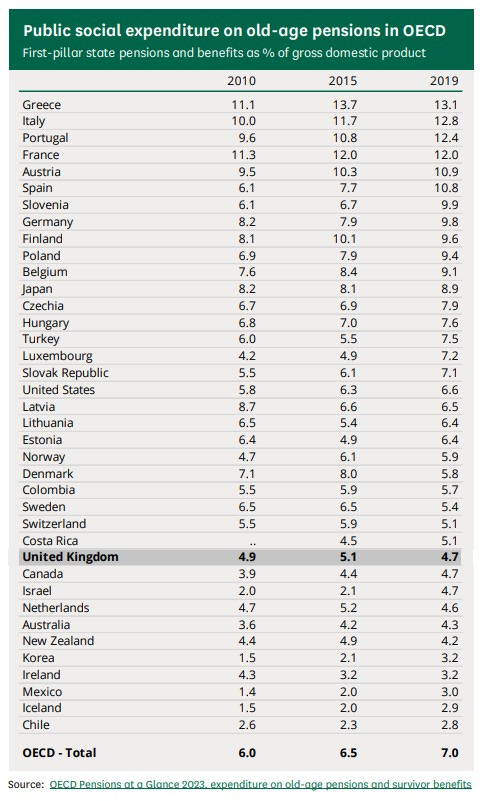

Specifically, the report looked at the future cost of publicly-funded pensions and hinted that spending rising to a predicted 7.7% of GDP in the 2070s would be some kind of catastrophe. There was no benchmarking to point out that many of our peer countries already spend more than that. If they can afford it today, why should we not be able to afford it by 2070?

The report also contains an assessment of the cost of tackling climate change – principally the cost to public finances, and again implies that this is a risk to debt sustainability

Even more shockingly, their analysis is based on an implicit assumption that the government cannot create money – ignoring the undisputed facts that we have for decades run a fiat currency and the Bank of England has since 2009 created a total of £895 billion to bail out the banks and to fund spending during COVID.

Extraordinarily, given those facts, the word fiat occurs precisely zero times in the entire report. A report on debt sustainability that does not mention that the government can create money is as useful as a report on tackling crime that does not mention the police.

In other words, the report is next to useless as a guide to policy-making.

Nevertheless, almost all our media report these conclusions as though the findings are reliable and responsible, and perpetuate the economically illiterate view that government finances are like household finances.

Even worse, the Treasury responded without challenging these points,

“We recognise the long-standing economic realities the OBR sets out in its report. This is why we are committed to ensuring stability in the economy through our non-negotiable fiscal rules, which have allowed us to invest in the UK to drive a decade of renewal and put more money in people’s pockets.”

There is a substantial risk that by treating the government finances like household finances, the UK will continue to erode its economic potential and be left with no option but to unwind its social contract and withdraw from the battle against climate change.

The alternative, of course, is to embrace the reality of how our economy really works and formulate policy on the basis of Keynes's dictum that "anything we can actually do, we can afford."

Here are links to related articles: on Debt hysteria, The household fallacy, How can we afford to rebuild?

If you’d like to read more of our content you can find it at the 99% website where you can also sign up to receive our newsletters and find our how you can get involved in our work.

Did you listen to The Briefing Room on Radio 4 yesterday re: Current Government Debt ? If so I would be interested to hear your analysis of it. I think the general message was one of concern rather than the rational arguments you put forward in your debt analysis.